An Innovative Solution Awarded by NASSCOM & FICCI

Best agri start-up in the application of digital technologies

Near Real Time Crop Health Assessment through the Season

Sowing progress, crop-specific acreage, crop health, yield estimates, sowing & harvest status

Interactive Mobile Application

Building last-mile communication with farmers through crop advisories I Best practices I Field data

Define Focused Go-to-Market Strategies

Identify villages of interest based on crop acreage, yield, and other parameters

Combining AI/ML & mathematical modelling

Insights to forecast pests & disease attacks, price volatility & agrarian distress

Who We Work For

Reinsurers and Brokers

Crop Insurance Companies

Farming, Agri-Input and Commodity Companies

Central and State Governments

The Social Sector

Banks & Financial Institutions

Here’s what makes us unique

Two decades of experience in agriculture

AI and ML Based approach

Use of remote sensing and GIS expertise

Proprietary Algorithms

Combines science and technology

Multidisciplinary experts

Know More to Grow More

About Cropalytics

RMSI Cropalytics focuses on data analytics that combines advanced modeling, machine learning, and crop and meteorological domain expertise to provide solutions to decision-makers in government, crop insurance, agriculture input sector, commodity trading, and social sector.

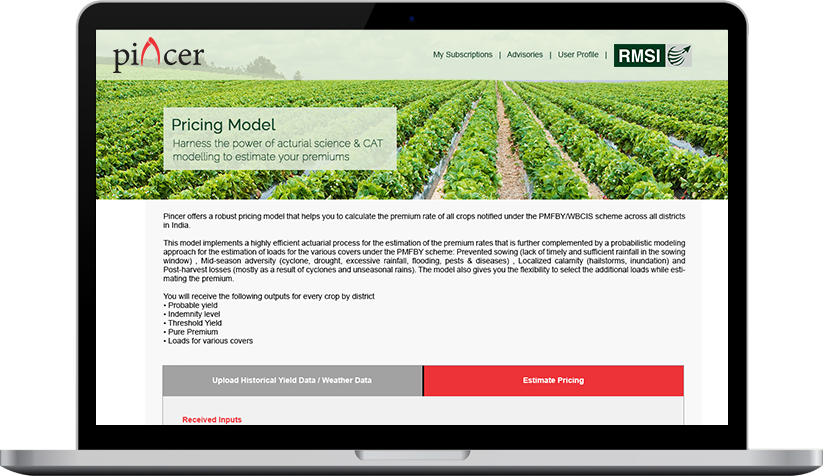

PInCER | Our Award-Winning Solution

Village Prioritization

In-Season Tracking

Farmer Risk Profile Verification

Farmer Decision Support System

Portfolio Analysis & Premium Calculator

Field Management System

600

Districts Yield Forecasted

650000

Villages Geo-referenced

20

Major Crops

3500000

Farmers Mapped

Our Blog

From Soil to Savings: Cutting CO₂ and Earning Credits

By Ritabrata Mitra, Sales Head, RMSI Cropalytics A new wave of opportunity is reshaping agriculture; farmers can now monetise sustainability. With the rise of carbon markets, reducing emissions is no longer just an environmental act but also an income-generating one. The concept of carbon credits is revolutionising farming like never…

Read more

India Kharif Cotton Yield: Climate Impacts & State-Wise Trends 2025

By Ritabrata Mitra, Sales Head, RMSI Cropalytics With the onset of the Kharif season, it’s impossible not to talk about the crop that dominates it, cotton. India’s textile industry is predominantly cotton-based, and cotton plays a crucial role in the country’s economy. The sector contributes nearly 2% to the country’s…

Read more

Early Monsoon in India 2025: Boon or Challenge for Farmers?

By Ritabrata Mitra, Sales Head, RMSI Cropalytics India, the land of festivals, has a habit of associating every major phenomenon with the same. Linked with festivals like Onam, Teej, and Aadi Perukku, is the joyous occasion of the monsoon. A country that celebrates and worships the monsoon clearly depends on…

Read morePEOPLE SAYS ABOUT Cropalytics

Clientele

© 2021 RMSI Cropalytics. All Rights Reserved.